Whether you’re a first-time buyer or an old pro at the real estate game, buying a home can be a daunting process. It’s an emotional time filled with difficult choices—and each decision you make has money riding on it.

Finding the right home to meet your family’s needs is hard enough. But knowing how to avoid paying too much for that home once you’ve found it is another job entirely.

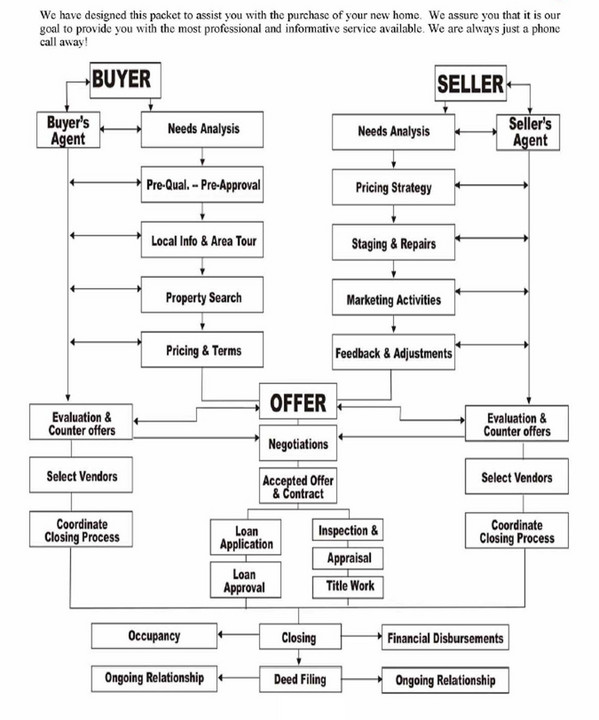

As someone who has helped countless buyers find their dream homes and save money at the same time, we’ve developed an outline to help you avoid the pitfalls inherent in the home buying process. We’ll show you not only how to make sure you’ve found the right home, but also how to negotiate a price to your advantage.

In today’s complex, fast-paced market, you can’t afford to learn these lessons through trial and error. The tips contained below will go a long way toward making you a savvy buyer.

Reasons to Buy a Home

1. Quality of Life

2. Tax Deductibility of Mortgage Interest

3. Tax Deductibility of Property Taxes

4. Appreciation Potential

5. Deferred Gain and Capital Gain Treatment

6. Principal Accumulation of Wealth

7. Pride in Your Home

8. No Landlord

9. Leverage (where else can you buy this size of an investment with 5-10% , possibly 0%down)

10. The Real Cost of Renting (At $700 per month, with a 6% rental increase per year, you will pay $110,719 over a 10 year period.)

10 Tips for First-Time Homebuyers

1. Be picky, but don’t be unrealistic. There is no perfect home.

2. Do your homework before you start looking. Decide specifically what features you want in a home and which are most important to you.

3. Get your finances in order. Review your credit report and be sure you have enough money to cover your downpayment and your closing costs.

4. Don’t wait to get a loan. Talk to a lender and get prequalified for a mortgage before you start looking.

5. Don’t ask too many people for opinions. It will drive you crazy. Select one or two people to turn to if you feel you need a second opinion.

6. Decide when you could move. When is your lease up? Are you allowed to sublet? How tight is the rental market in your area?

7. Think long-term. Are you looking for a starter house with the idea of moving up in a few years or do you hope to stay in this home longer? This decision may dictate what type of home you’ll buy as well as the type of mortgage terms that suit you best.

8. Don’t let yourself be “house poor”. If you max yourself out to buy the biggest home you can afford, you’ll have no money left for maintenance or decoration or to save money for other financial goals.

9. Don’t be naïve. Insist on a home inspection and, if possible, get a warranty from the seller to cover defects within one year.

10. Get help. Consider hiring a Real Estate Agent as a buyer’s representative. Unlike a listing agent, whose first duty is to the seller, a buyer’s representative is working only for you. And often, buyer’s reps are paid out of the seller’s commission payment.

Ten Things to Know When Buying a Home

1. Don't buy if you can't stay put.

If you can't commit to remaining in one place for at least a few years, then owning is probably not for you, at least not yet. With the costs of buying and selling a home, you may end up losing money if you sell any sooner.

2. Start by shoring up your credit.

Since you most likely will need to get a mortgage to buy a house, you must make sure your credit history is as clean as possible. A few months before you start house hunting, get copies of your credit report. Make sure the facts are correct. Fix any problems you discover.

3. Aim for a home you can really afford.

The rule of thumb is that you can buy housing that runs about two-and-one-half times your annual salary. But you'll do better to use one of the Internet's many calculators to get a better handle on your income, debts, and expenses and how those affect what you can afford.

4. Don't worry if you can't put down the usual 20 percent.

There are a variety of public and private lenders who, if you qualify, offer low-interest mortgages that require a down payment as small as 3 percent of the purchase price.

5. Buy in a district with good schools.

This advice applies even if you don't have school-age children. Reason: When it comes time to sell, you'll learn that strong school districts are a top priority for many home buyers, thus helping to boost property values.

6. Get professional help.

Even though the Internet gives buyers unprecedented access to home listings, it's still a good idea to use an agent. Look for an exclusive buyer agent, if possible, who will have your interests at heart and can help you with strategies during the bidding process.

7. Choose carefully between points and rate.

When picking a mortgage, you usually have the option of paying additional points -- a portion of the interest that you pay at closing -- in exchange for a lower interest rate. If you stay in the house for a long time -- say five to seven years or more -- it's usually a better deal to take the points. The lower interest rate will save you more in the long run.

8. When house hunting, bring your camera.

Or at least a notebook to jot down reminders, since after you look at a half-dozen or so houses the details begin to blur in your mind. The best choice would either be an electronic camera that lets you take notes right on the image, or a Polaroid so that you can scribble comments in the margins.

9. Do your homework before bidding.

Your opening bid should be based on the sales trend of similar homes in the neighborhood. So before making it, consider sales of similar homes in the last three months. If homes have recently sold at 5 percent less than the asking price, you should make a bid that's about eight to 10 percent lower than what the seller is asking.

10. Hire a home inspector.

Sure, your lender will require a home appraisal anyway. But that's just the bank's way of determining whether the house is worth the price you've agreed to pay. Separately, you should hire your own home inspector, preferably an engineer with experience in doing home surveys in the area where you are buying. His or her job will be to point out potential problems that could require costly repairs down the road.